Protecting your Assets

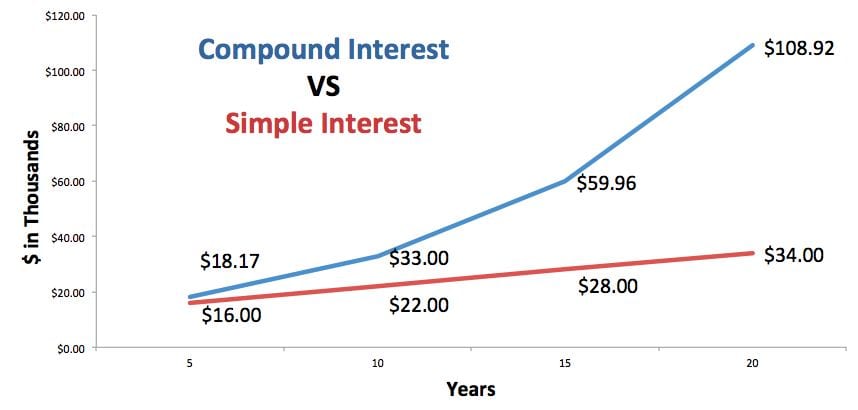

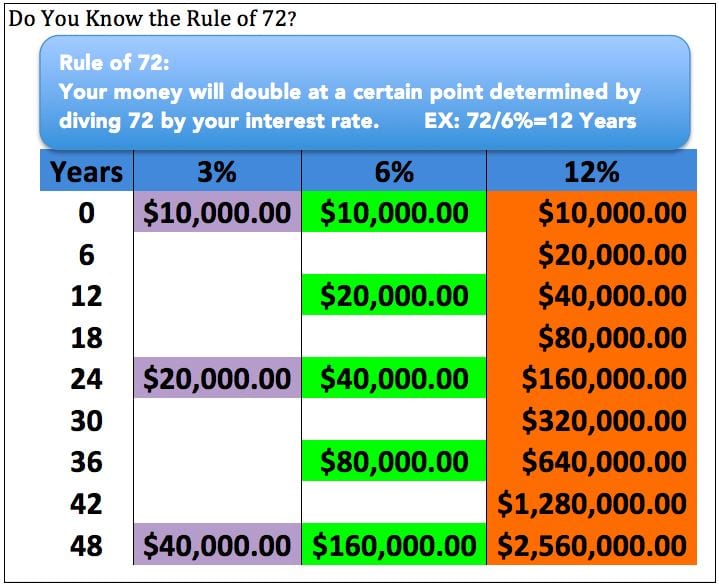

Saving takes discipline and the ability to visualize the impact of future actions. When paying off debt, there is an important principle to consider; we should invest in things that have similar risks to the things we are paying off. Investing money in the market, only to find out when we are ready to pay-off the debt that the market is down extending our pay-off for a number of years, is frustrating and deflating.

These habits can help us to balance our budget, establish emergency savings, pay-off our debt, and build a stable financial base. Learning to save and paying off our debt are critical skill sets we must have to become financially self-reliant!